Understanding Stock Splits

Are you starting to explore investing in the stock market but need help understanding some terminologies? If so, you may have come across the concept of a "stock split" and are wondering what it means. A stock split is one strategy companies can use to adjust the market price of their shares or modify shareholder equity without reducing company value. It's important to understand how businesses operate in capital markets today, so let's break down exactly what it means and why investors look out for them.

What is a stock split?

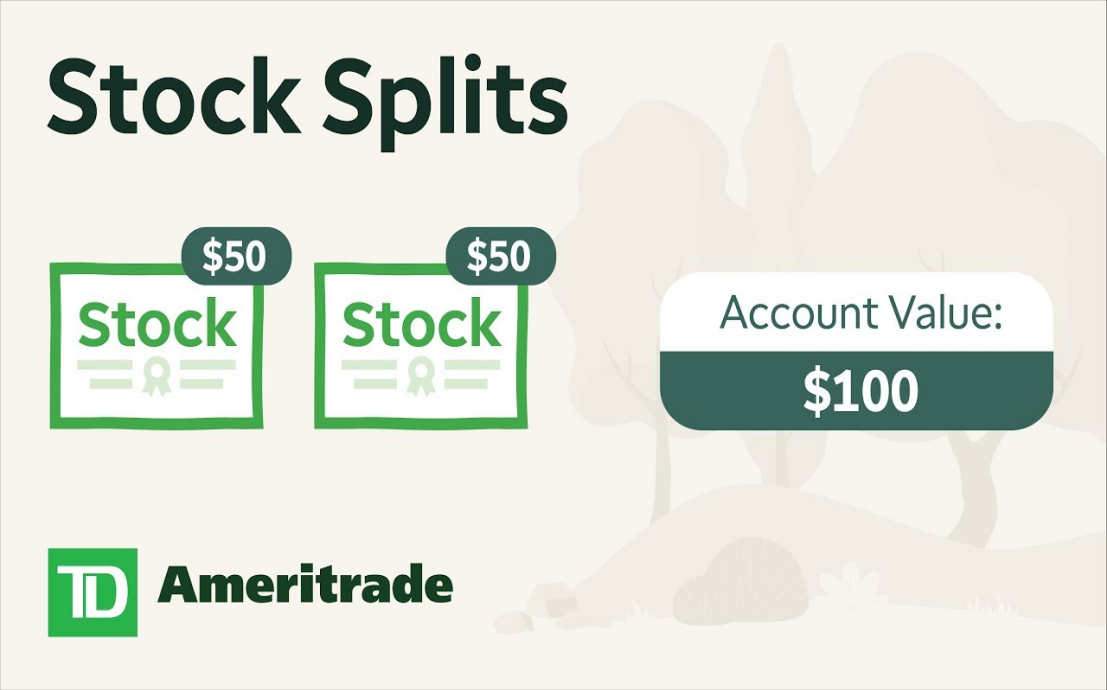

Companies will often choose to undertake a stock split to reduce the market price of their security and make it more accessible for certain investors or market makers. After such an action is taken, each investor's pre-split share total increases - however, the overall dollar value of their investment remains unchanged. By dividing existing shares into multiple ones through this

process, companies can provide better access at lower prices without sacrificing equity.

How do stock splits affect a company's stock price?

Stock splits often make stocks more affordable for the average investor, likely creating more demand and increasing stock prices. This is not always true, but multiple companies have seen their share prices rise after a split in the past. Investing in such stocks could be an excellent opportunity to benefit from this trend.

What are the benefits of a stock split?

Companies and investors alike can benefit from a stock split in numerous ways. By making the shares more accessible to small investors and market makers, companies can help reduce their cost of capital. For investors, it makes otherwise pricey security easier to acquire by allowing them to purchase larger shares at a reduced price. Additionally, this process creates increased liquidity in the marketplace, which subsequently allows for faster transactions when buying or selling investments.

Knowing the concept of stock splits can help investors determine which stocks to put their money in. Substantially comprehending how these corporate activities sway different components of trading is vital for any investor trying to reap profits from the stock market. With this knowledge, you'll be better equipped to select which stocks are viable investments and when it's time to do so.

How do stock splits affect shareholders?

When a company starts a stock split, shareholders are affected in multiple ways. Generally speaking, the number of shares they hold will proportionally increase, and their par value per share will decrease correspondingly. In other words, while the total dollar amount remains unchanged for investors' holdings, they may find themselves with more stocks than before!

With more shares from a stock split, shareholders gain access to greater potential returns on their investment. If the share price increases post-split, investors will benefit even more than before. Not only does this mean larger rewards for current stakeholders, but it can also increase the company's overall performance!

What are the drawbacks of a stock split?

While stock splits may benefit some investors, they must also beware of their potential drawbacks. After a split, the share price is reduced, which can render it less attractive to certain investors. Additionally, lowered par value implies that dividends generated by those shares will decrease compared to before the split occurred.

Moreover, a company's market value might become too high when dealing with stock splits - while not always true, this could potentially lead an investor into overpaying for shares post-split if they are unaware of this possibility.

Stock split calculator

is a great tool if you want to determine the impact of a stock split. It considers factors such as the number of shares outstanding, the split ratio, and the current market price of the stock to calculate what will happen to its overall value after the split. The calculator can help investors decide whether or not to invest in a company after the split has occurred since it can help them see whether or not the stock has increased in value. Additionally, it can be used to determine how much of a share an investor already owns will be worth after the split is completed. This information can then be used to calculate overall investment returns and decide when to buy and sell.

FAQs

How often do companies split their stock?

Stock splits are a rare event with no set timeframe. Companies may divide their stock into multiple parts if the share value has become too expensive, making it inaccessible for smaller investors. Thus, they will issue additional shares and reduce each individual's cost per share so that it is more attainable by all buyers. Splits can occur occasionally or as part of a long-term plan; some companies split their stocks every few years while others might never do so - there is no guarantee either way!

How do I know if a company is planning a stock split?

Trying to determine if a company will initiate a stock split can be like trying to guess the future. Generally, companies announce any plans before their effective date, and investors should watch out for official news releases from the company and other financial websites for updates. Furthermore, analysts may have an inkling of potential splits in research notes or press interviews, which are worth monitoring too! It is essential to remember that these predictions do not guarantee a split and should only be employed as a reference point. Moreover, if you have invested in the company's stock, your broker may alert you of any divisions.

What happens after a stock split?

After a stock split is executed, the company's share price generally decreases as the number of outstanding shares increases. This makes stocks more accessible to investors and can result in increased trading activity. It also indicates that management believes in their future performance and may attract new long-term investors who view it as an indication of strong fundamentals.

What should I do if I own stock in a company that is splitting its stock?

When your company undergoes a stock split, the number of shares you own in that company will amplify, yet their worth will diminish. Fortunately, this won't affect the total value of your investment since it should stay equivalent to its previous degree.If you are looking to maximize potential gains from the split, then buying or selling shares at the new price may be beneficial. Nonetheless, it is important to remember that stock splits do not guarantee any future success and should only form part of an effective investment plan.. Additionally, it is always recommended to consult your financial advisor before making any major investment decisions.

Is a split good for a stock?

Stock splits can be beneficial to a company's share price, as it makes investing in the stock more economical and available for smaller investors. Furthermore, some may regard this split as an advantageous sign that the organization is performing well and its shares are underestimated. Consequently, there could potentially be higher trading activity after a split occurs.

It's essential to keep in mind that stock splits don't promise any future gains, and should be viewed as part of a diversified investment approach. Ultimately, whether or not a split is advantageous for your individual stock depends on the investor's objectives and risk appetite.

Conclusion

To increase shareholder value and the stock price, a company may choose to split its existing shares into multiple new ones. Referred to as "stock splitting," this can be an effective strategy - but it's essential that investors gain insight into how it works before making such decisions.

Before making any investments in a company that has just experienced a stock split, it is essential to conduct extensive research so you are aware of the risks associated. Thank you for taking the time to read this!