What Causes Oil Prices to Fluctuate?

Oil influences a variety of aspects of our everyday lives including transportation, manufacturing costs, and heating needs, so understanding what components drive the market provides insight into why this commodity’s cost is not always stable.

In this blog post, we will examine what causes oil prices to move both up and down by discussing some key concepts such as supply and demand as well as global politics. We will also talk about potential strategies for fans of bartering since speculation plays its own role in pricing volatility.

The factors that cause oil prices to fluctuate

It can be divided into two main categories known as supply and demand. Supply and demand is a basic economic principle that shows that prices in any market are determined by the number of goods or services available for sale, compared to the number of people willing to buy them.

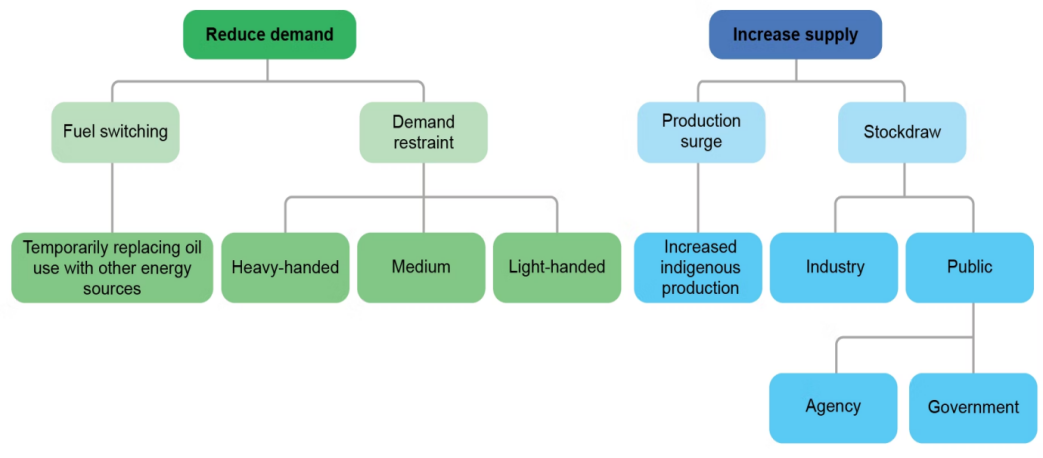

When there is a shortage of oil, meaning that there is not enough being produced to meet the demands of those wanting to buy it, the price increases. On the other hand, when there is an abundance of oil and not enough people buy it, the price decreases.

The second major factor that affects oil prices is global political events or economic activity. For instance, if a country’s economy is performing poorly then this can lead to a decrease in the demand for oil, resulting in lower prices. Conversely, if there is an increase in global economic activity or certain political events such as sanctions against oil-exporting countries, this could lead to an increase in the cost of oil.

The short-term and long-term effects of fluctuations in oil prices

Oil prices are subject to short-term and long-term fluctuations. In the short term, factors such as weather, supply disruptions due to political unrest, refinery outages, and speculation can cause rapid changes in the price of oil. On the other hand, long-term trends tend to be driven by larger economic forces that impact the global demand for oil.

Factors that influence the long-term price of oil include global economic growth, technological advances in energy production, government regulations, and trade policies, as well as geopolitics.

When the supply of oil is low due to natural or human causes such as wars or embargoes, it can cause prices to rise drastically—sometimes within a matter of days or weeks. On the other hand, an oversupply of oil caused by increased production or slower-than-expected global demand can cause prices to drop quickly and suddenly.

In addition to supply and demand, speculative trading also plays a role in fluctuations in oil prices. When traders believe that the price of oil will increase, they may buy up large amounts of oil futures to take advantage of the potential profit.

This can cause prices to go up, even if there is no real fundamental reason why they should do so. Similarly, when traders believe that prices will decrease, they may sell off their holdings, which can put downward pressure on prices.

How to protect yourself from the negative effects of high oil prices

Oil prices can have a significant impact on our everyday lives, from the cost of transportation to home heating costs. Thus, it is important to protect ourselves from the negative effects of high oil prices by understanding and preparing for their fluctuations.

Firstly, make sure you are informed about current events that might be affecting oil prices such as political tensions, extreme weather conditions, or changes in production. This can help you plan accordingly and adjust your budget to accommodate potential price hikes.

Secondly, consider investing in oil futures and stocks as a way to hedge against the potential losses from sudden price fluctuations. While this strategy does come with its own risks, it can be beneficial if done correctly.

Finally, look into alternative sources of fuel to reduce your dependence on oil-based products and help offset potential price increases. This could mean switching to electric cars, solar panels, or other renewable energy sources.

By following these steps, you can ensure that you are better prepared for any changes in the oil market and minimize the negative effects of high oil prices.

Tips for reducing your dependence on oil

With oil prices in a constant state of flux, it is important to be aware of ways to reduce your dependence on this commodity. Some tips for decreasing your need for oil include:

- Investing in alternative fuel sources: Investments in renewable energy such as solar and wind power can help decrease our reliance on traditional fossil fuels like crude oil.

- Utilizing public transportation: Depending on how close you live to work or school, using public transportation such as a bus or subway can save you money and reduce your need for oil.

- Installing efficient appliances: Taking the time to invest in energy-efficient products such as light bulbs, washing machines, and refrigerators can significantly reduce your energy bills and oil usage.

- Making smart travel decisions: Instead of driving several times a day, consider carpooling or using ride-sharing services. This can greatly reduce the amount of gasoline you use on a daily basis.

Taking steps to lessen your dependence on oil is critical in these uncertain economic times. By following the tips outlined above, you can save money and help protect the environment.

By understanding what causes oil prices to fluctuate and taking steps to minimize our dependence on this commodity, we can make smart economic decisions that will benefit both ourselves and the planet.

The future of oil prices and what it could mean for you

Oil prices are constantly changing based on a variety of factors and while it can be difficult to predict, there are a few methods that may help you determine the direction oil prices could take in the future.

By analyzing global economic indicators such as GDP growth, population trends, and consumer spending, you can get an idea of what the demand side of the equation may look like. On the supply side, keeping an eye on production levels and technological advances that may change how quickly oil can be extracted from the ground can provide information about what could affect pricing in the future.

When it comes to understanding oil prices, being aware of global politics is also important. Political instability in countries that produce large amounts of oil or the implementation of sanctions on certain countries can both have a significant effect on the global oil market. Understanding what political events could potentially affect pricing is crucial to keep an eye on how much you may need to budget for oil prices in the future.

By being aware of all these factors, you can better prepare for changes in oil prices. Keeping an eye on global markets and being knowledgeable of economic, political, and technological trends can help you gain a better understanding of how oil prices may fluctuate in the future. Knowing what could potentially affect pricing can help you plan your budget and business activities accordingly.

FAQs

What are three things that affect oil prices today?

Oil prices are driven by a variety of factors, including global demand and supply, geopolitical events, and speculation.

Global demand for oil affects its price due to the limited availability of resources. Supply disruptions such as wars or natural disasters can also affect oil prices significantly.

Political unrest in countries that produce oil, like Venezuela and Iran, often leads to instability in the oil markets. Finally, speculation by investors and traders plays a major role in the fluctuation of oil prices.

What drives up or down in oil prices?

The demand for oil drives up its price when there are limited resources available or when it is expected that demand will increase in the future. Supply disruptions due to wars, natural disasters, or political unrest can also drive up prices. On the other hand, increases in supply due to a production surge can drive down oil prices. Additionally, speculation by investors and traders can cause short-term fluctuations in the market that drive either up or down in oil prices.

How does global politics affect oil prices?

Global politics can have a significant impact on oil prices. Political unrest in countries that produce oil can disrupt the supply of resources and drive up prices.

For example, sanctions placed on Iran by the United States caused an increase in oil prices due to decreased production from the country.

Additionally, political instability in major consuming countries like China or India can cause oil demand to fluent and, in turn, affect prices.

Conclusion

An understanding of what drives the price of oil is essential to making informed decisions in regard to energy production, consumption, consumption policy, and price volatility.

The factors that affect supply and demand are complex and intertwined, as each decision or change has a ripple effect throughout the global economy. Knowing which elements are in play can give you an advantage when it comes to avoiding sudden shifts in prices.

Economic conditions such as GDP growth, along with geopolitical events like unrest in the Middle East can both have significant impacts on the pricing of oil. Governments can also intervene by imposing taxes and imposing restrictions on production or exports. Even natural disasters may indirectly affect oil prices both locally and across other markets.

Analyzing these underlying factors can help us understand why oil prices rise and fall, allowing us to make more informed decisions when it comes to energy investments and strategies going forward.