What Is a Term Loan?

Are you looking for a loan option to help kick-start your business’ growth or get through an unexpected financial hardship? Term loans may be the answer.

A term loan is a type of loan that provides a lump sum of money upfront, which is then repaid in equal installments over a set period of time - typically 1-5 years - making it ideal for purchases requiring large sums of money.

In this blog post, we'll explore what exactly makes up a term loan and how to determine if one might be right for you!

What is a term loan and how does it work?

A term loan is a type of loan that provides businesses with a lump sum of money upfront, which is then repaid in equal installments over a set period of time - typically 1-5 years.

It can be used for almost any business expense such as purchasing new equipment, investing in marketing and advertising campaigns, expanding operations, and more. The loan is designed to help you finance long-term investments or large purchases that require upfront capital.

The repayment schedule for a term loan can vary depending on the lender and the type of loan but usually involves fixed monthly payments over an extended period of time. Interest rates are typically fixed, as well, meaning that you will pay the same amount each month until the loan is paid off.

The benefits of a term loan

When used for business purposes, a term loan can offer several benefits that may be just the capital boost you need. Here are some of the most common advantages:

Affordability: Term loans come with fixed repayment terms, which makes them an attractive option for borrowers who want to keep their monthly payments predictable and manageable over time.

Flexibility: Depending on your credit history, lender, and other factors, you may be able to get better terms and lower interest rates on a term loan than with an unsecured line of credit or business credit card.

Speed: Term loans can often be approved faster than traditional financing options like SBA loans or venture capital investments, making them ideal for businesses with urgent financing needs.

Preservation of equity: With a term loan, you won’t be giving up any ownership stake in your business like you would with the sale of stock or venture capital investment.

How to qualify for a term loan

Qualifying for a term loan is similar to any other type of loan. You’ll need to have good credit, demonstrate your ability to repay the loan and provide financial documents such as bank statements and tax returns. Other factors that lenders look at include:

Business Structure – What kind of business structure do you have? Sole proprietorships, partnerships, and corporations all have different requirements when it comes to loan qualification.

Time in Business – How long has your business been in operation? Lenders often prefer businesses that have been operating for at least two years before they’ll consider giving them a loan.

Collateral – What collateral do you have to offer? What assets can you provide as security for a loan? Real estate, equipment, and inventory are all common types of collateral that lenders may require.

Revenue – What is your business’s annual revenue? Lenders want to see proof of consistent cash flow to ensure you will be able to pay back the loan in a timely manner.

By understanding these four factors, you can better determine if you qualify for a term loan and if it’s the right financial tool for your business. Remember to always compare offers from multiple lenders before making any decisions, as each lender will have their own requirements and criteria for qualification.

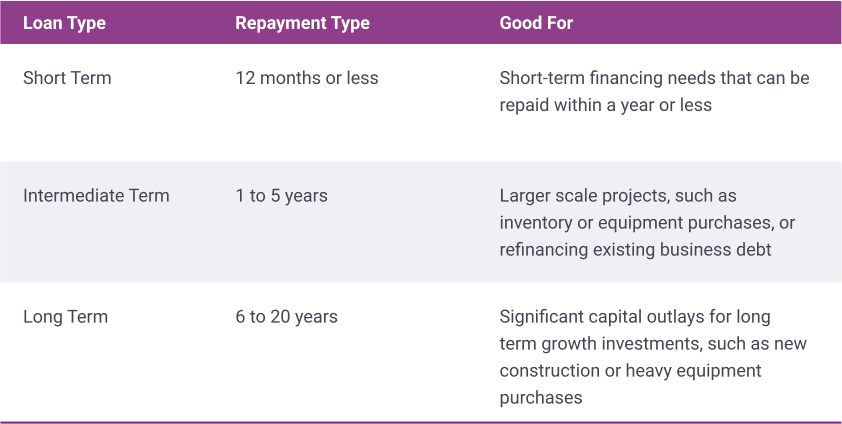

The different types of term loans available

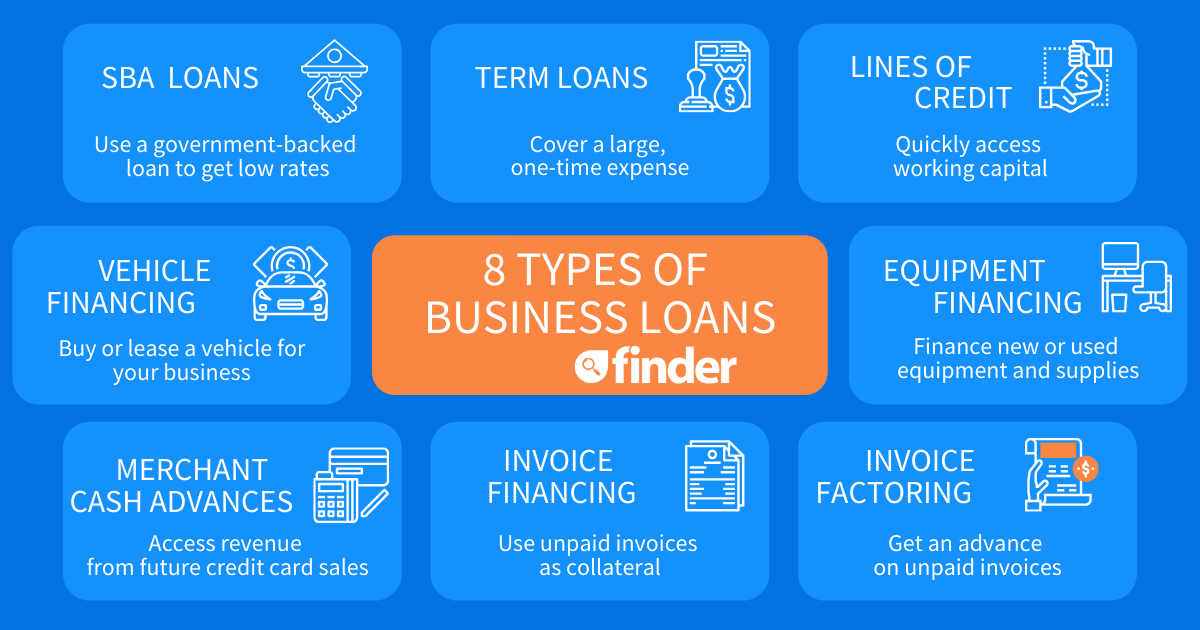

When it comes to term loans, there are several different types on the market. Before you consider taking out a loan, make sure you understand the differences between them and how they might affect your business’s bottom line. Here are some of the most common types of term loans:

Traditional Term Loan: These loans offer a fixed amount of money with a predictable rate of interest that must be paid back on a set schedule.

Small Business Administration Loans (SBA): SBA loans are government-guaranteed, meaning they offer more favorable terms and lower interest rates than traditional term loans.

Merchant Cash Advance: A merchant cash advance (MCA) is a type of loan that advances funds in exchange for a cut of your future sales. This can be an attractive option for businesses with good credit and high revenue, but can also come with higher interest rates and fees than other types of term loans.

Equipment Financing: If you need equipment to run your business, equipment financing may be the right option for you. This type of loan allows businesses to purchase equipment upfront, with the cost divided up into manageable payments over the course of several months or years.

Line of Credit: A line of credit is similar to a traditional term loan, but with one key difference – instead of receiving a lump sum, you’re given access to a predetermined amount of money that can be drawn upon as needed.

No matter which type of loan is right for you and your business, understanding the different types available and their respective terms can help you make an informed decision and avoid potential pitfalls in the future.

How to choose the right term loan for your business

When it comes to finding the right term loan for your business, there are a few key factors to consider.

First, you'll need to determine how much money you need and how long of a repayment period best suits your needs. While short-term loans - typically 1-2 years - can offer quick access to capital and are often easier to qualify for, longer repayment terms - up to 5 years - may be more suitable if your project requires a larger sum of money.

You'll also want to look at the loan's interest rate and fees. Compare offers from different lenders to find the best options for your business and make sure you understand all of the associated costs.

Finally, consider how the loan will affect your cash flow. Make sure that you're able to comfortably manage your monthly payments while also balancing any other existing debt obligations and business expenses.

The risks associated with term loans

While term loans can be a great option for businesses that need a lump sum of money upfront, there are some risks associated with them that you should consider before taking one out. The most significant risk is failure to pay back the loan on time and in full. This could result in expensive late fees, additional interest, or even legal action if it goes unpaid for too long.

Another risk to consider is that the interest rate of a term loan can be higher than other types of loans, especially if you have bad credit. Additionally, you may not get as much flexibility with your repayment terms or loan amounts as you would with other options such as a line of credit. It’s important to weigh the pros and cons of a term loan to make sure it’s the best option for your business.

When considering a term loan, it’s also important to look at other options that may be available to you and compare the terms and conditions of each one. This will help you determine which option fits your needs best and can provide the most benefit to your business.

Ultimately, a term loan can be a great option for businesses that need quick access to funds and have the ability to pay back the loan in full and on time. However, it’s important to consider all of the risks associated with this type of loan before making any decisions.

FAQs

What does a term loan mean?

A term loan is a type of loan that provides a lump sum of money upfront, which is then repaid in equal installments over a set period of time - typically 1-5 years. This type of loan is usually used to finance larger purchases that require large sums of money and could be secured or unsecured depending on the lender's requirements.

How do I qualify for a term loan?

To qualify for a term loan, you’ll need to meet certain criteria set by the lender. These typically include having a good credit score, a steady income, and sufficient collateral (if necessary). You’ll also need to provide proof of your ability to repay the loan in the form of bank statements, tax returns, and other financial documents.

What are the terms associated with a term loan?

The terms associated with a term loan depending on the lender and their specific requirements. Generally, though, you can expect to pay back the loan over 1-5 years at an interest rate that is fixed for the entire loan duration. You may also have to provide collateral in order for the lender to extend a term loan to you, depending on your credit score.

Conclusion

As you can see, term loans offer businesses a great opportunity to take their operations to the next level. When considering whether or not a term loan is right for your business, ensure that you assess all the associated risks and benefits.

Additionally, make sure you understand the repayment guidelines and payout schedules of your chosen lender. By keeping these key points in mind, you can ensure that a term loan is able to provide substantial financial assistance tailored to meet your unique needs.

Taking advantage of the resources offered by lenders is integral in helping businesses remain competitive in an ever-changing marketplace. Ultimately, understanding what a term loan is and how it works can give business owners clarity as they make decisions about their financial future.