What Is a Voided Check? | How to Write a Voided Check

Have you ever wondered what a voided check is or why it is important? A voided check can come in handy when making direct deposits, setting up pre-authorized debits and payments, and other types of financial transactions. In this blog post, we'll explain the basics about what a void check is and how to write one—so you can rest assured knowing there will be no confusion or mistakes next time you need to submit one. Read on for all of the essential facts you'll need to make life easier with your banking!

What is a voided check and what is it used for?

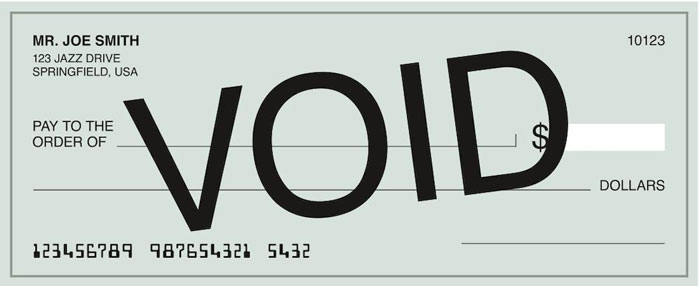

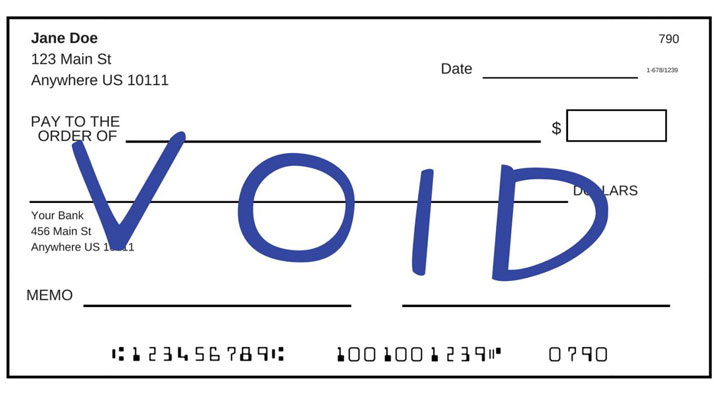

A voided check is a type of check that has been marked as “void” and cannot be cashed or deposited. The purpose of a voided check is to provide proof of account information such as the bank routing number and account number for setting up direct deposits and payments. Voided checks are typically used to set up automatic payments from a bank account, such as paying rent or a mortgage.

Voided checks typically include all the information that appears on regular checks, including the check number, payee name, and signature line. However, since voided checks cannot be cashed or deposited, they also contain a “VOID” stamp or designation somewhere on the check.

You can request a voided check from your bank or you can print one directly from your online banking system. Some banks also offer digital versions of voided checks to set up direct deposits and payments.

How do you void a check and why would you want to do that?

A voided check is a check that has been marked as invalid and cannot be cashed by anyone. This can be done by writing the word “VOID” across the front of the check or marking it in some other way.

Voided checks are often requested when setting up direct deposits and automatic bill payments, or when opening a new bank account. By voiding a check, you ensure that the funds will not be removed from your account without your knowledge or permission.

It effectively protects against potential fraud and unauthorized payments from being drawn from your account.

Voided checks are also commonly used for tax purposes when filing returns or verifying income. Providing a voided check helps the IRS confirm your bank details and verify that any payments you are making or receiving are legitimate.

In addition to providing security and protecting against fraud, voiding a check is also a simple way to keep track of your finances. By taking the time to mark checks as void, you can ensure that you are not accidentally double-paying for something or forgetting to cancel a transaction.

Overall, voided checks provide an extra layer of security and convenience when managing your money. By voiding a check, you can rest assured that your funds are safe and sound.

What are the consequences of voiding a check and how can you avoid them?

Voiding a check can have serious consequences, especially if you are not careful and the check is used fraudulently. When you void a check, the information on the check will still exist in your record-keeping system.

This means someone could use that information to deposit or cash the check, even though it has been voided.

If the check is used fraudulently, you could be liable for any losses or other expenses incurred as a result of the fraudulent activity. To avoid this risk, it is important to ensure that all voided checks are marked as "VOID" and are kept in a secure location where they cannot be accessed or altered by someone else.

Additionally, if you are using electronic banking, make sure that all voided checks are also marked as "VOID" in the record-keeping system and not just in the physical check itself.

Finally, it is important to keep accurate records of when and how a check was voided so that you can easily prove that it was not used fraudulently. Keeping up with these simple steps can help ensure that you avoid any potential consequences of voiding a check.

Are there any other ways to pay bills or transfer money without using a voided check?

Yes! There are a number of ways to pay bills or transfer money without having to use a voided check. Many banks now offer the ability to make electronic transfers from your account, either through online banking or a mobile app.

You can also set up automatic payments for recurring bills with many companies, which eliminates the need for you to manually write out and mail a check each time. Additionally, you can use digital payment services such as PayPal or Venmo to make payments to friends, family, and businesses without needing to write a check at all.

These methods may be more convenient than using a voided check and can also save time in certain situations. However, it is important to remember that when using electronic payments, you are responsible for ensuring the correct amount and payee information is entered.

It's also a good idea to keep track of all your payments, both digital and physical, to ensure everything remains up to date. By doing this, you can avoid any potential confusion or issues down the line.

Can I still use my old checks if they've been voided?

Yes, you can still use your old checks if they have been voided. A voided check is simply a check that has been marked as invalid or unusable. This could be because the amount of the check was incorrect, or because there were other errors on the check.

When a check is voided, it cannot be used to pay for goods or services. Instead, the check should be destroyed and a new check written out to replace it. This is done to ensure that no one can use your old checks for fraudulent purposes.

It's important to remember that even if you have voided a check, it may still show up on your bank statement as a pending transaction. This is because some banks process transactions before they are actually voided, so it may take several days for the bank to cancel the check and remove it from your statement.

If you have security concerns about using old checks after they've been voided, you should contact your bank or financial institution directly. They will be able to provide you with more information about how their policies work and what steps you can take to ensure that your checks are secure.

How do I make sure my checks don't get voided in the first place?

If you want to avoid having your checks voided, there are a few steps you can take:

- Make sure the check is properly filled out. This means ensuring that all of the necessary information is included, such as payee, date, amount and payment memo if any. It also means double-checking for typos or other errors.

- Ensure that you have enough funds in your account to cover the amount of the check before you write it out. If there aren’t enough funds, the check will be returned and voided automatically by your bank or financial institution.

- Sign the check with a signature that matches the one on file at your bank or financial institution. If the signature doesn’t match, the check will be voided.

- Keep track of all your outgoing checks, if possible. This way, you can avoid accidentally writing out a duplicate check and having it voided.

FAQs

What Is a Voided Check?

A voided check is a check that has been canceled or rendered invalid from its original purpose. It is typically done by writing the word “VOID” across the front of the check, making it impossible for someone to cash or deposit it. A voided check may be requested by an employer to set up direct deposit, or by a financial institution to verify that a customer has access to a specific bank account. A voided check can also be used for safety reasons, as it does not contain any personal information about the account holder other than their name and address.

What Is the Difference Between a Voided Check and a Blank Check?

A voided check has the word "VOID" written across it, making it unable to be cashed or deposited. A blank check on the other hand, does not have any writing present and is still able to be used for its intended purpose.

Conclusion

I hope this article has helped explain what a voided check is and why it is necessary. A voided check can be an essential tool for businesses, as it helps to ensure that payments can be made easily and securely. However, it is important to remember that a voided check should never be used as a form of payment or identification. If you have any questions or concerns about voided checks, please consult your bank or financial institution for more information. Thanks for reading and best of luck in all your financial endeavors!